The Role of an Offshore Trustee in International Asset Protection

The Role of an Offshore Trustee in International Asset Protection

Blog Article

Recognizing the Role of an Offshore Trustee: What You Need to Know

The function of an offshore trustee is commonly misunderstood, yet it plays an essential part in protecting and managing properties throughout borders. The intricacies involved in selecting the ideal trustee and the potential repercussions of that choice warrant careful factor to consider.

What Is an Offshore Trustee?

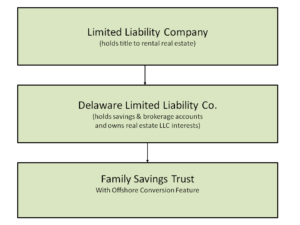

An offshore trustee is a specialized fiduciary that carries out counts on developed in jurisdictions outside the person's country of house. This function typically develops from the wish for possession security, tax obligation performance, or enhanced privacy. Offshore trustees are typically used by individuals looking for to handle their wealth in a fashion that abides by international regulations while optimizing advantages afforded by certain territories.

The selection of an overseas trustee is vital, as it includes delegating them with considerable economic properties and the authority to make choices relating to the monitoring and distribution of those possessions. Offshore trustees might be institutions or individuals, such as banks or trust fund firms, and they must have a deep understanding of worldwide law, tax policies, and the particular specifications of the count on agreement.

In addition, the jurisdictions in which these trustees run usually have desirable legal structures that help with effective trust management, giving a layer of safety and stability for the settlor's possessions. It is important for individuals thinking about an overseas depend involve with certified legal and financial advisors to make certain that their choice of trustee lines up with their purposes and follow the relevant laws.

Trick Duties of Offshore Trustees

Offshore trustees bring a variety of vital duties that are vital to the efficient management of counts on. Among their key tasks is to make certain compliance with the appropriate regulations and laws of the offshore territory, which needs a thorough understanding of both international and local legal frameworks - offshore trustee. This aids safeguard the count on's assets and makes sure correct tax obligation treatment

An additional essential duty is the accurate record-keeping and economic reporting. Offshore trustees need to keep comprehensive accounts of all purchases and supply beneficiaries with transparent reports, guaranteeing that the beneficiaries are notified about the depend on's efficiency.

In addition, trustees should copyright fiduciary obligations, acting in excellent faith and prioritizing the rate of interests of the beneficiaries above their very own. This entails making fair and fair decisions pertaining to distributions and taking care of problems of passion. In general, an overseas trustee's role is important in securing the trust's integrity and guaranteeing its long-lasting success.

Benefits of Utilizing an Offshore Trustee

Using an offshore trustee offers various advantages that can enhance the management and protection of trust fund assets. Offshore jurisdictions commonly supply durable lawful structures that guard possessions from lenders, suits, and political instability in the grantor's home nation.

Additionally, overseas trustees commonly possess customized know-how in international financing and tax obligation regulation, allowing them to maximize the count on's monetary framework. This competence can cause favorable tax planning opportunities, as certain territories might offer tax rewards that can enhance the general value of the count on.

Confidentiality is an additional considerable advantage; lots of overseas jurisdictions copyright strict personal privacy regulations that secure the information of the trust and its recipients from public analysis. This confidentiality can be essential for people looking to preserve discernment concerning their monetary events.

In addition, overseas trustees provide a degree of professional administration that can ensure adherence to legal requirements and ideal practices. By delegating these duties to seasoned specialists, trustors can concentrate on other elements of their financial preparation while enjoying satisfaction concerning their trust assets.

## Factors to Think About When Selecting a Trustee

Selecting the ideal trustee is an essential choice that can dramatically impact the effectiveness and longevity of a click to read more trust fund. A number of aspects must be thought about to ensure that the trustee straightens with the count on's recipients and goals' demands.

First of all, evaluate the trustee's experience and expertise in managing counts on. An ideal trustee this should have a strong understanding of count on law, investment techniques, and financial management. This proficiency guarantees that the trust's properties are handled effectively and according to the settlor's wishes.

Second of all, think about the trustee's online reputation and dependability. Performing thorough research study right into the trustee's history, including referrals and testimonials from previous customers, can offer insights right into their dependability and specialist conduct.

Furthermore, assess the trustee's interaction abilities and accessibility. A trustee must be able to clearly articulate trust-related issues to beneficiaries and be accessible for updates and discussions.

Legal and Tax Implications

Browsing the lawful and tax implications of appointing an overseas trustee is necessary for making sure conformity and making best use of the benefits of the trust fund structure. The option of jurisdiction plays an essential duty in identifying the lawful framework governing the trust. Various territories have differing regulations worrying property defense, personal privacy, and the legal rights of recipients, which can considerably influence the effectiveness of the depend on.

Recipients may be subject to taxes in more tips here their home country on distributions obtained from the overseas count on. Furthermore, particular jurisdictions impose taxes on the trust fund itself, which can deteriorate its overall worth.

Moreover, compliance with coverage requirements, such as the Foreign Account Tax Obligation Compliance Act (FATCA) for united state people, is necessary to avoid charges. Involving with tax specialists and lawful advisors that specialize in offshore structures can supply essential understandings and guarantee the trust is developed and preserved abreast with all appropriate regulations and regulations. By carefully taking into consideration these implications, individuals can shield their assets while enhancing their tax settings.

Verdict

In conclusion, the function of an offshore trustee is vital for efficient property monitoring and protection. offshore trustee. By functioning as a fiduciary, overseas trustees make sure conformity with international policies, focus on recipients' interests, and offer specific knowledge in monetary and tax obligation matters. Careful consideration of aspects such as experience, online reputation, and administrative ramifications is necessary when picking a trustee. Eventually, understanding these aspects adds to notified decision-making relating to possession management approaches and depend on administration.

An offshore trustee is a specific fiduciary who provides depends on developed in territories outside the person's nation of house.Offshore trustees carry a range of vital responsibilities that are essential to the efficient management of counts on. Overall, an overseas trustee's function is essential in protecting the count on's honesty and guaranteeing its long-lasting success.

Utilizing an offshore trustee provides various benefits that can improve the administration and security of trust assets.Browsing the legal and tax ramifications of appointing an overseas trustee is important for making certain conformity and maximizing the advantages of the trust structure.

Report this page